-

Notifications

You must be signed in to change notification settings - Fork 12

Reporting

The Solidus TaxJar extension integrates with TaxJar's reporting feature. It does this by syncing the information required by TaxJar when the order is shipped.

Solidus TaxJar also provides an order reporting backfill feature. This lets you easily sync any historical orders to TaxJar. You may want to use this if you installed this extension halfway through a tax period you intend to generate TaxJar reports for.

This article provides information about how to use and understand the reporting features as they're built into the Solidus TaxJar extension. Note that this article assumes you have already installed the Solidus TaxJar extension and connected it to your TaxJar account using an API key.

If TaxJar has no record of a historical order, from before the Solidus TaxJar extension was installed, Solidus TaxJar cannot sync changes to that order to TaxJar. This means syncing an unreported order that is being refunded or recalculated will fail. To remedy this you can use the backfill order interface to first sync the historical orders that you may want to re-report in the future.

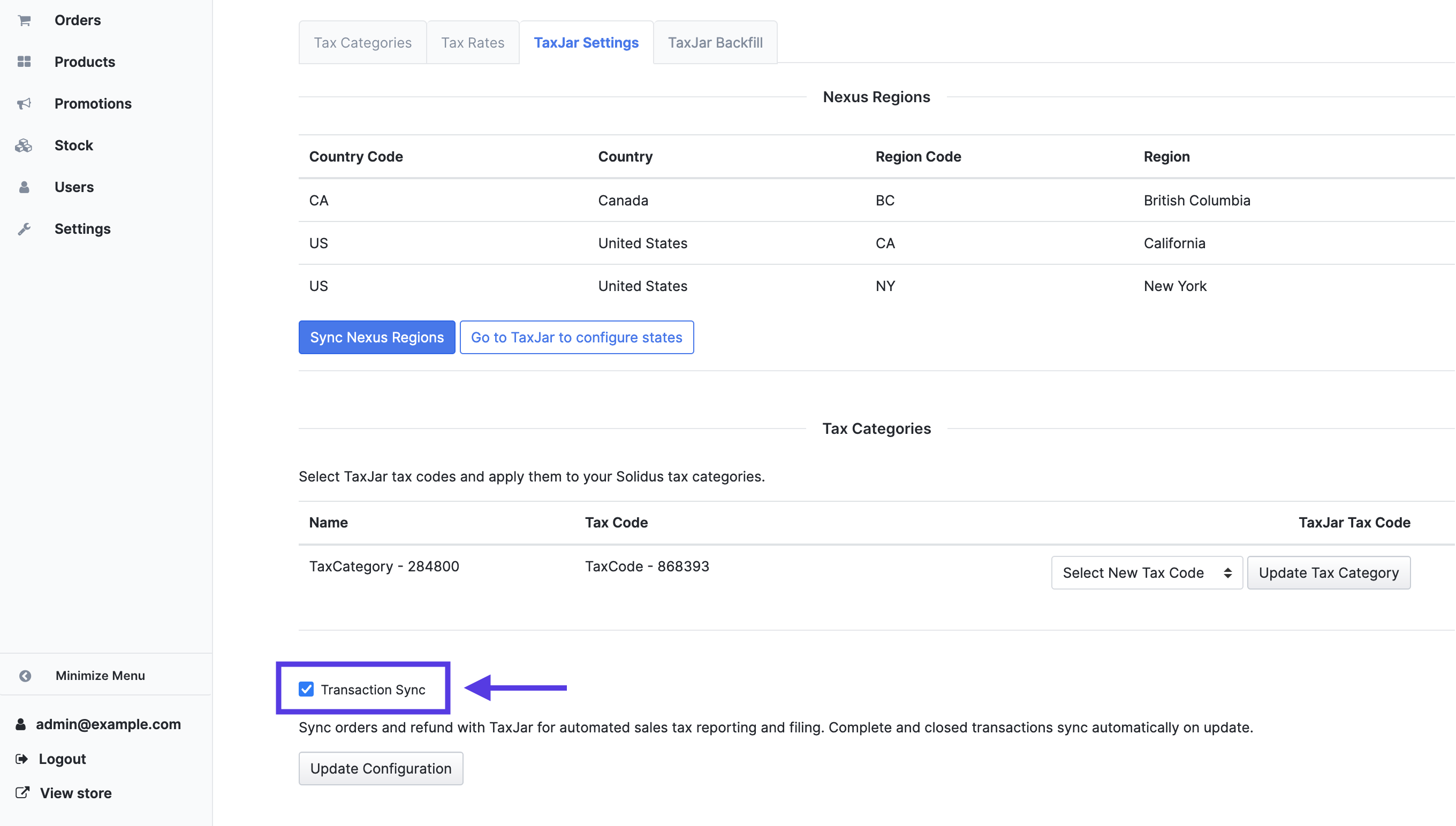

From the Solidus admin:

- Use the main navigation menu to go to Settings > Taxes.

- From the Taxes landing page, navigate to the TaxJar Settings tab.

- Scroll down and check the Transaction Sync checkbox.

- Press the Update Configuration button. When the page reloads, you should see a message: "TaxJar settings updated!"

Any orders that were completed and shipped before reporting syncing was turned on will remain unsynced. But you can use the order reporting backfill interface to sync them later.

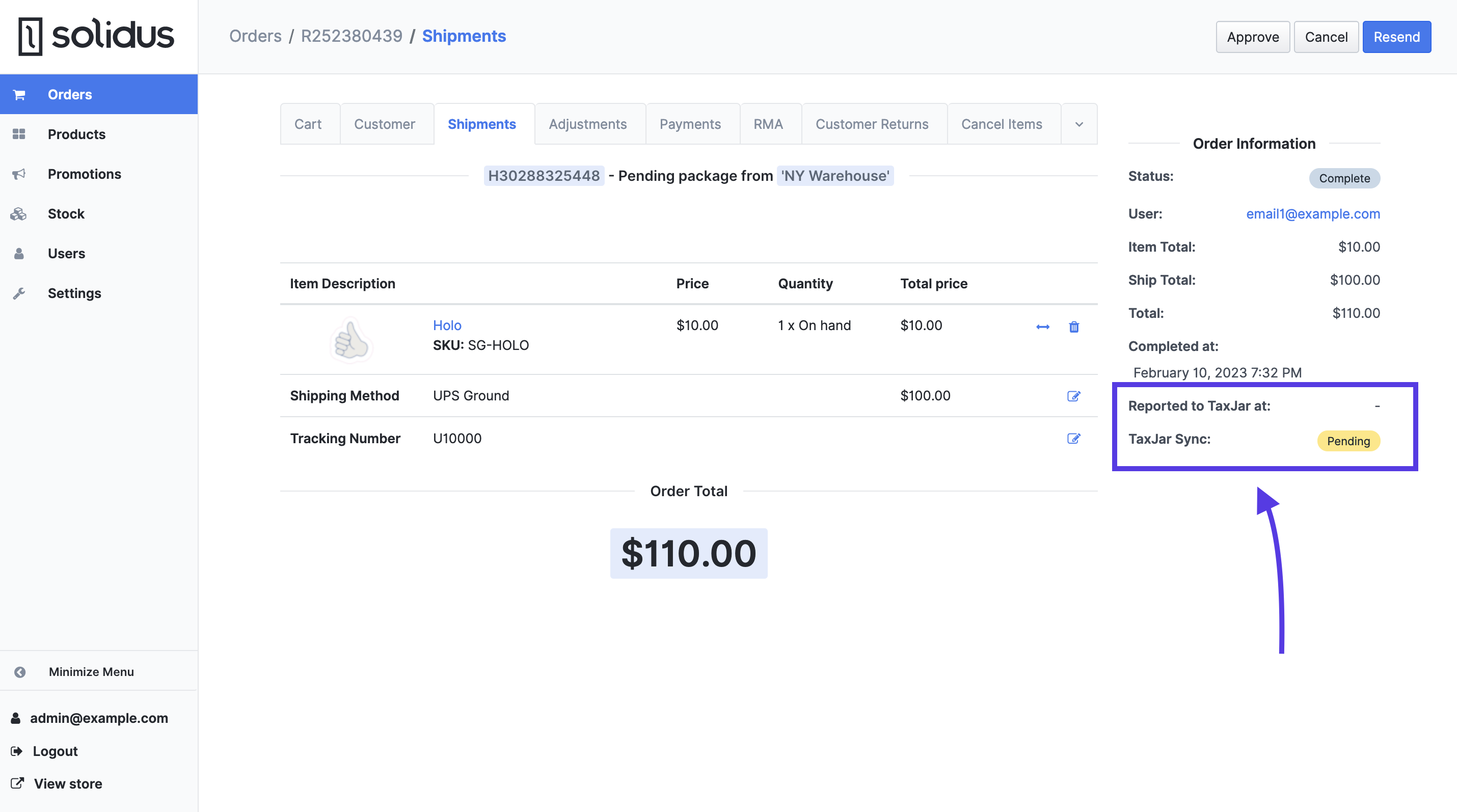

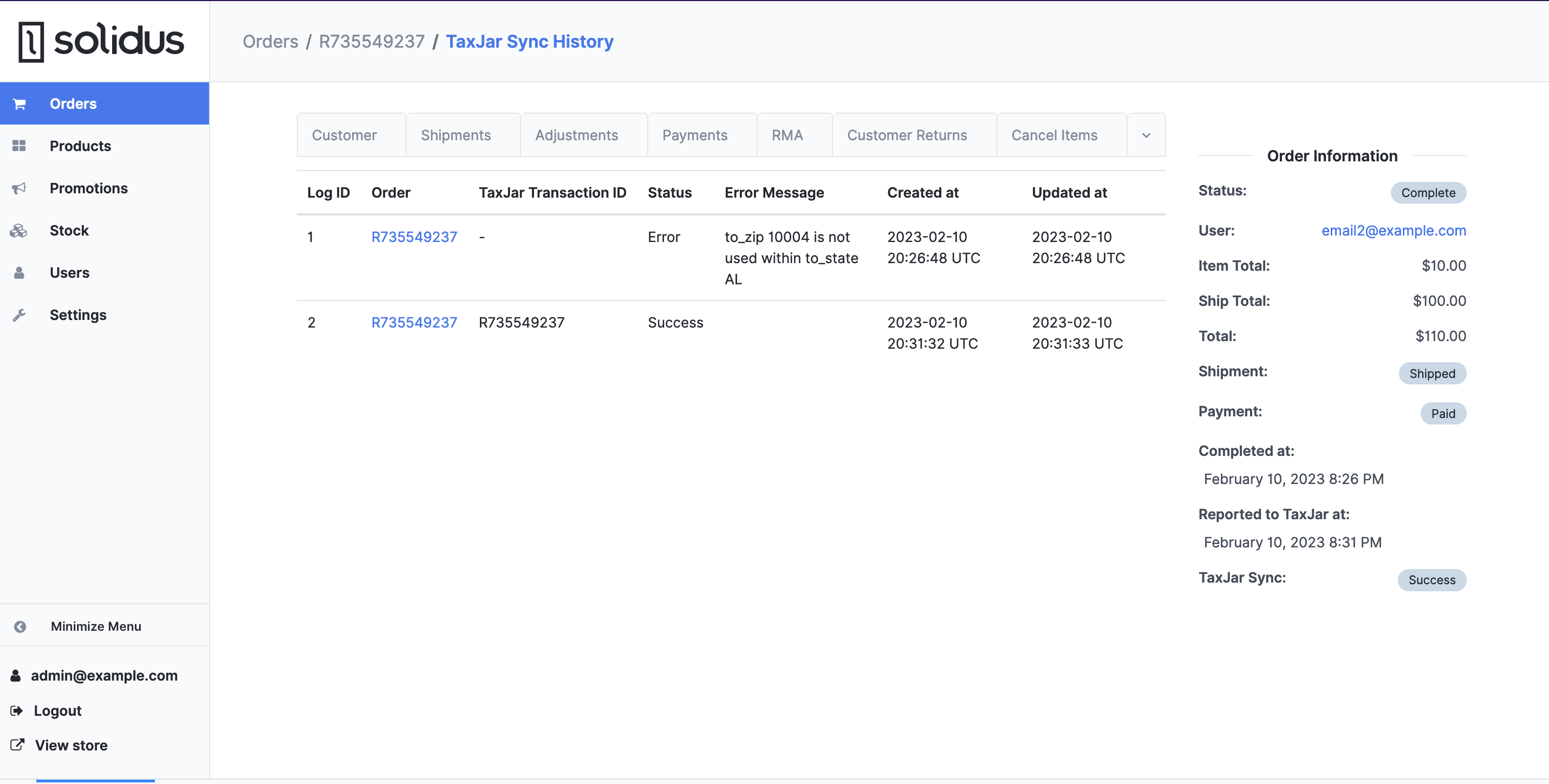

Solidus TaxJar gives orders a TaxJar sync state and sync history. Solidus admin users can quickly check whether, and when, an order has been synced to TaxJar this way.

There are six sync states:

- Disabled: This indicates that the reporting sync feature is disabled. The state won't change until the reporting sync functionality is turned on in the Solidus TaxJar settings interface.

- Pending: This indicates that the reporting sync feature is enabled, but the current order has not been synced to TaxJar.

- Processing: This indicates that the order is currently being synced to TaxJar.

- Success: This indicates that the order has successfully been synced to TaxJar.

- Error: This indicates that there was an issue syncing the current order to TaxJar. In the case of an error, check the order's TaxJar Sync History tab to get more information about why the sync failed.

To view an order's sync state:

- Navigate to the order in the Solidus admin.

- Check the right-hand order summary pane for the Reported to TaxJar at timestamp and the TaxJar Sync status indicator.

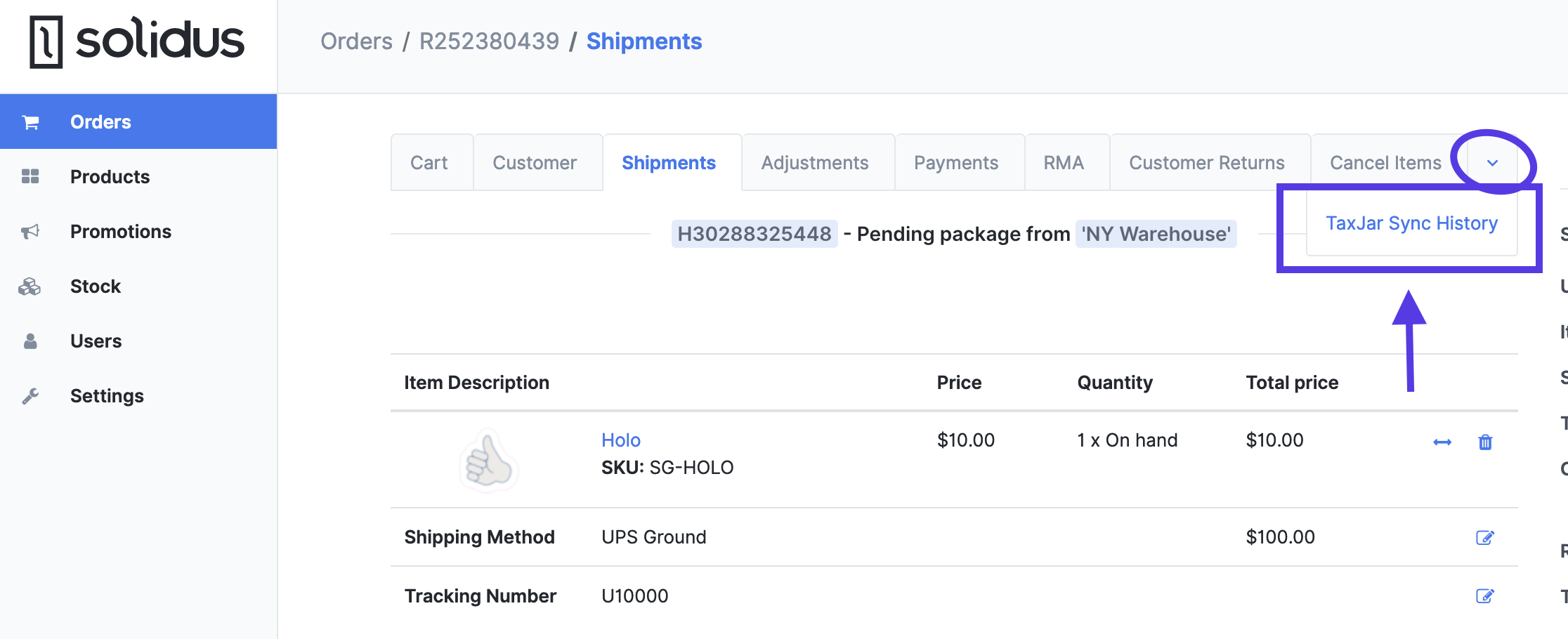

If you need more information about the history of the sync state, navigate to the TaxJar Sync History tab for the order.

If you want to sync historical Solidus orders to TaxJar for reporting purposes, you can use the order backfill interface.

From the Solidus admin:

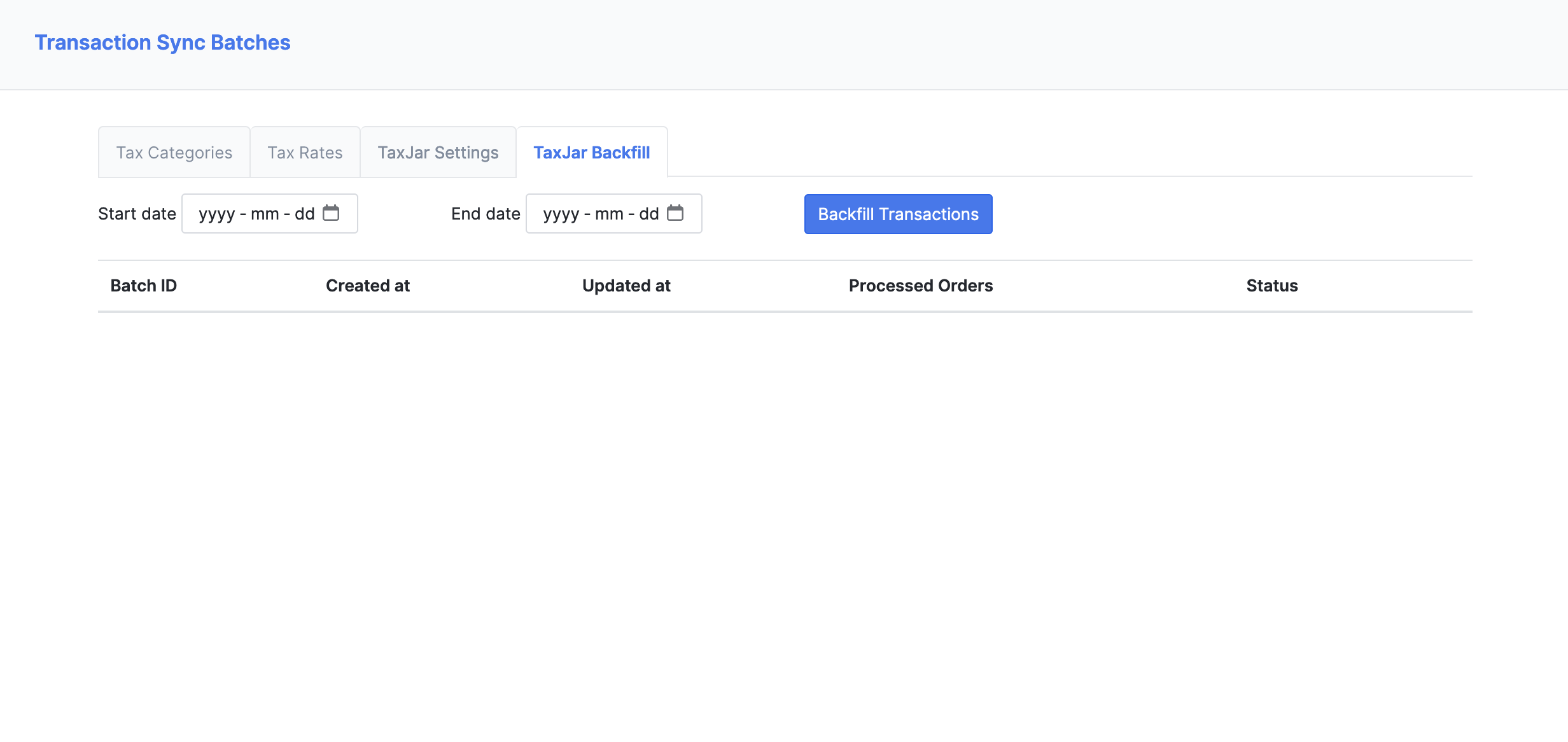

- Use the main navigation menu to go to Settings > Taxes.

- From the Taxes landing page, navigate to the TaxJar Backfill tab.

- Enter a start date, an end date, and press the Backfill Transactions button to start a backfill batch.

Depending on the amount of orders in the batch, it may take some time to complete to backfill process. But you can view the orders to be synced and the current progress by clicking the ✏️ Edit button next to the in-progress backfill batch.