Teacher : 王寬裕

TA : 黃瑀柔

Email: tsuzidou

FB : 106學年度長庚資管會計學(甲班)

一種資訊系統,經過一定的程序,提供企業財務資訊,協助決策者進行判斷與決策。

程序包含辨認、衡量、紀錄、分類、彙總、分析與溝通等程序。

- 企業個體假設

- 貨幣單位假設

- 會計期間假設

- 繼續經營假設

- 資產

- 負債

- 權益

- 收入

- 費用

- 類別:資產、負債、業主權益、收入、費用

- 性質別:流動資產、非流動資產(以一年區分流動與非流動)

- 項目別:如流動資產中再分為現金、應收帳款、存貨等

- 子目別:如應收帳款中再區分:A公司、B公司等

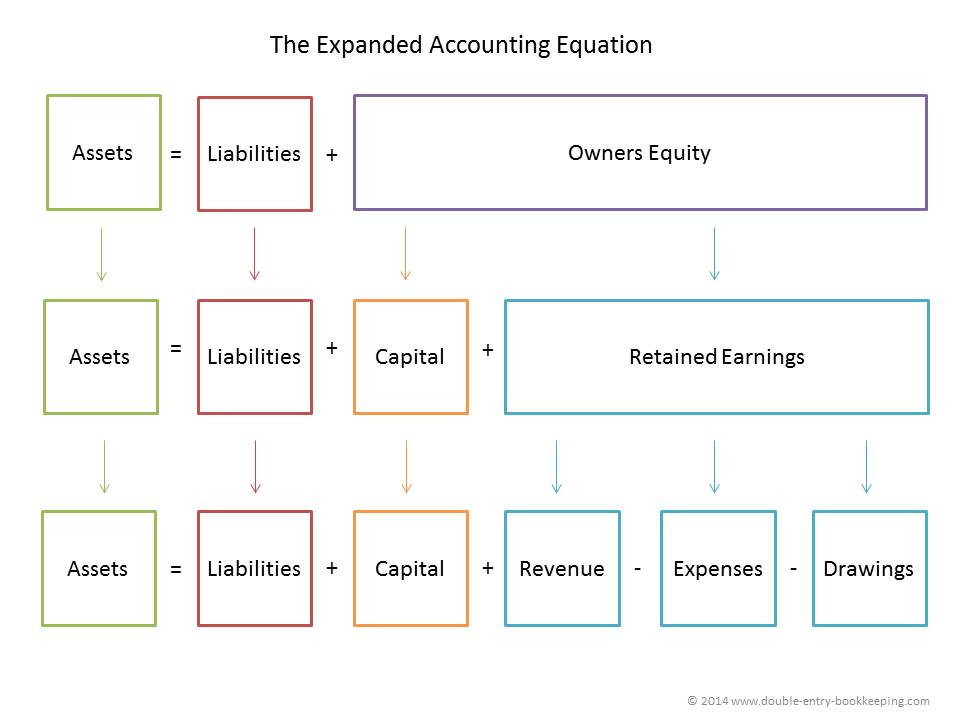

Assets (資產) = Liabilities (負債)(外來資金) + Equity (淨值, 權益, 產權)(自有資金)

E = A - L Debits = Credits 左:Debit / 右:Credit

- Assets: Cash、Accounts Receivable(應收帳款)、Inventory(存貨)、Supplies(辦公用具)、Prepaid Insurnace(預付保險金)、Land、Buildings、Equipment

- Non-Current Assets

- Current Assets

- Liabilities: Accounts Payable(應付帳款)、Notes Payable 應付票據(銀行借款)、應付薪資帳款{借現金, 貸應付薪資帳款}、Salaries & Wages Payable(應付薪資費用)、Interest Payable、Unearned Service Revenue(應收服務收入)

- Equity

- Non-Current Liabilities

- Current Liabilities

- Equity: 股本(Share Capital)、收入(Credit)-成本費用(Debit)、Retained Earning(保留盈餘/累積盈餘)、Dividends(股利、紅利)

Share Capital Ordinary 普通股

- Revenues (Credit)

- Cost and Expense (Debits)

- Cost of goods sold

- Operating Expenses

- Freight-Out

- Rent Expense

- Salaries and Waged Expense

- Utilities Expense(水電費)

- Insurance Expense

- 借項 Debit : 資產、費用

- 貸項 Credit

借 資產

貸 金流

ex. 餐廳訂桌 總金額 $6000<br/>

買方:預付訂金 $3000

借 預付訂金 $3000 要求 -> 資產

貸 現金 $3000

賣方:餐廳會計紀錄 收訂金 $3000

借 現金 $3000

貸 預收訂金 $3000

- 公司: 借 cash(現金)

貸 capital(資本)

- 個人: 借 投資

貸 現金

借 現金 30000

貸 股本 30000

借 存貨 20000

貸 現金 20000

借 現金 15000

貸 銷貨收入 15000

借 銷貨成本 10000 (Cost of Sales)

貸 存貨 10000

借 現金 10000

貸 銷貨收入 10000

借 銷貨成本 5000

貸 存貨 5000

借 銷管費用 5000

貸

** 買保單(兩年保)

第一年:

借 prepaid insurance

貸 cash

第二年:

借 insurance cost

貸 prepaid insurance

公司宣布發放股利

借:Dividends

貸:Dividends Payable

實際發放股利

借:Dividends Payable

貸:Cash

簡略:

借:Dividends

貸:Cash

-> 借:Retained Earning

-> 貸:Dividends

??

遞延項目:

服務性質

Day 1

借 Cash 10000

貸 Unearned Service 10000

Day 3

借 Cash + Unearned Service 10000 + 20000

貸 Prepaid Service Revenue 30000

- 借 Dr.

- 貸 Cr.

- Source Document 原始憑證

- Bookkeeping Voucher 會計/記帳憑證

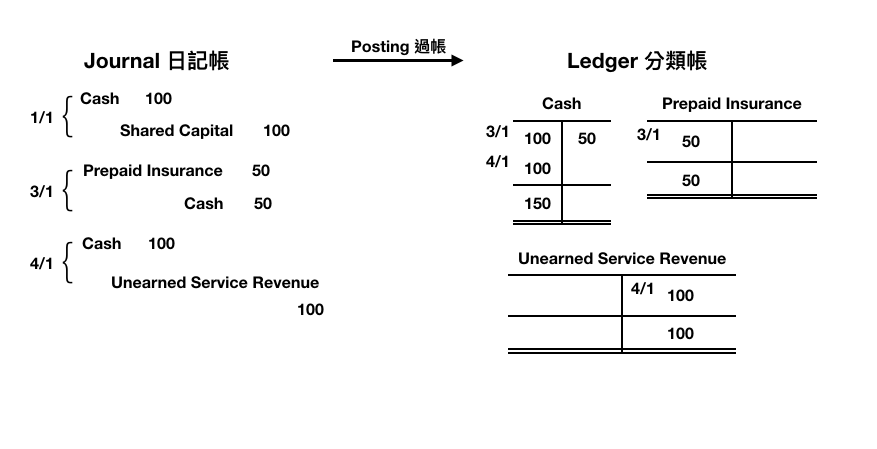

- Journal 日記帳

Journal Post (過帳) to Ledger

- Ledger 分類帳

- Unadjusted Trial Balance

- Adjusting Entries

- Adjusted Trial Balance

- Preparing Financial Statement

- CLosing Entries

- Post-Closing Entries Trial Balance

- Cash

- Purchases

- Merchandies Inventory

- Credit Sales

- Accounts Receivables

- Cash Collectiton

- 授權

- 執行

- 紀錄

- 保管

- Revenue Recognition Principle

- Expense Recognition Principle (Matching Principle 配合原則)

- 時效性 Timeliness

- 年報

- 半年報

- 季報

- 月報

- 資產負債表 / 財務狀況表 (平衡表 Balance Sheet)

- 資產 & 負債

- Cash 應歸類至此報表

- 綜合損益表

- 內部使用者 : 企業管理階層、員工等

- 外部使用者 : 投資人、債權人、主管機關等

- 流動比率 Current Ratio = 流動資產 / 流動負債 (Current Assets / Current Liabilities)

- 負債對權益比率 Total Debt to Equity = Total Liabilities / Shareholders Equilty (銀行稱之負債比率)

Total Debt to Assets 負債比率 = Total Liabilities / Total Assets

- 淨利率 Net Profit Margin = Net Income / Sales

- 遞延項目 Deferrals

- Prepaid Expenses 預付費用

- Unearned Revenues 預收收入

- 應計項目 Accruals

- Accrued Revenues 應收帳款

- Accured Expenses 應付帳款

-

財務結構 / 財務狀況

-

應收帳款 => A/R -> Assets

-

應付帳款 => A/P -> Liabilities

-

預付保險費(Prepaid Insurance)

-

分錄 => Entry

-

銷貨毛利:銷貨收入-銷貨成本

-

淨利:Net Income

-

售出前的所有花費都會被分類到存貨管理成本

-

IFRS : International Financial Report Standard 國際財務報表準則

-

GAAP : Generally Accepted Accounting Principles 一般公認會計原則

-

股本:普通股、特別股(優先享有股利分配)

-

OCI Other Comprehensive Income 其他綜合損益

-

Margin 利潤

-

IFRS: 應計會計基礎(權責基礎)、現金會計基礎 => 認列

-

Accumulated Depreciation 累計折舊 借 折舊費用 (擺在資產的減項) 貸 累計折舊

-

Book Value (B.V.) 帳面價值(p.109)

The purpose of depreciation is not valuation but a means of cost allocation

- accrued interest 應計利息

- Contra asset account = 抵銷帳戶 -> Accumulated Depreciation(p.108)

- Trial Balance 試算表

Exercise : 1-5、1-15(p.40)、2-1(p.82)、{2-2、2-3}、(p.43)、1-13(財務狀況表)、2-10(p.83)、2-3(p.84)、2-1(p.88)、p.92(2-4B)、p.112、p.118、p.138(BE3-7、BE3-9)、p.140(DO3-2)、p.142(E3-7)、p.144(E3-13)、p.144(E3-12)

- p.144(E3-13)

Accounts Receivable $8800 to $10000 (+1200 @ Debit)

Service Revenue $34000 to $35200 (+1200 @ Credit)

.

貸 Supplies $2300 to $700 (-1600)

借 Supplies Expense $0 to $1600 (+1600) . 借 1500 貸 1500 . 借 折舊費用 $1300 貸 累積折舊 $1300 . 借 Salaries & Wages Expense $1100 貸 Salaries & Wages Pabale $1100 . 借 Unearned Rent Revenue $700 貸 Rent Revenue $700

- BE3-9 股本股票 不用計入 net income 中

p43 return eraning $1520

E3-7

2018/04/12

- 幫企業做會計

- 借 Cash 1000

- 貸 Share Capital 1000

- 幫投資人做會計(交易分錄)

- 借 Investement 1000

- 貸 Cash 1000

IFRS(歐洲) / 台灣分錄表結構與其順序問題

IFRS Equitment -> Cash

台灣 Cash -> Equitment

保留盈餘表 - 期初 : net income、dividend、retained earning

diveident 位在 借項 Debit

調整分錄

-> 產生報表時處理 (依主管機關要求)

-- 註 #15、#16、#18

借 insurence expense

貸 prepaid insurence expense

- (1) E1-5

- (2) E1-13

- (3) DO IT! 2-2

- (4) DO IT! 2-3

- (7) E3-7

- P2-4A、P2-4B

-

- Cash

- Account Receivable

- Supplies

- Inventory

- Prepaid Insurance

- Interest Receivable

- Land

- Equipment

- Accumulated Depreciation

-

- Accounts Payable

- Notes Payable

- Unearned Service Revenue

- Salaries & Wages Payable

- Interest Payable

- Dividends Payable

- Income Tax Payable

-

- Share Capital - Preference

- Share Capital - Ordinary

- Retained Earnings

- Dividends

- Income Summary

-

- Service Revenue

- Sales Revenue

- Sales Discounts

- Sales Returns & Allowances

- Interest Disposal of Plant Assets

-

- Depreciation Expense

- Income Tax Expense

- Insurance Expense

- Interest Expense

- Loss on Disposal of Plant Assets

- Maintenance & Repairs Expense

- Rent Exense

- Salaries & Wages Expense

- Selling Expenses

- Supplies Expense

- Utilities Expense