Tool for comparing profitability of treasury bonds

- customization of investment parameters,

- customization of bonds parameters,

- comparison of bonds (charts),

- optional adjustment for inflation,

- data export/import,

- sharing via url,

- two languages:

enandpl.

The tool was developed to help people answer the following question: "Which bonds will be more profitable in my case?". It was inspired by people purchasing 4-year bonds instead of 10-year bonds, because they didn't want to freeze their money for a decade. However, it was more profitable to cancel 10y bonds after 4 years than to keep 4y bonds for the same duration. Many people didn't do the calculation and they lost an opportunity to earn more money.

- This is not an investment recommendation.

- Computer programs may have bugs - always do your own calculations before investing.

git clone https://github.com/wpazderski/bonds-cmp.git

cd bonds-cmp

npm ci

npm run build

Upload contents of ./build/ directory to your server (destination directory depends on server's configuration). See CRA deployment documentation for more information.

- Click the flag in the top-right corner if you want to change interface language.

- Open

Settingstab (open by default) to adjust investment and environment parameters:- currency, amount of money to invest, investment duration and income tax rate,

- whether to automatically adjust interest rates if bonds are repeated (it happens if investmentDuration > bondsDuration),

- predicted inflation rates and reference rates.

- Open

Bondstab to configure bonds. There are some bonds defined by default - these are treasury bonds offered in Poland. You can remove them and add your own bonds.- each interest period can be repeated ("Number of repeats") - there is a difference between 3x4months and 1x12months because of cancellation policy, capitalization and additive inflationRate/referenceRate,

- configure interest rate; example:

- percent is 5.5%,

- "Add inflation" is enabled and inflation rate is 13.7%,

- "Add reference rate" is enabled and reference rate is 8.25%,

- interest rate is 5.5% + 13.7% + 8.25% = 27.45%,

- configure cancellation policy (fees applied if you cancel the investment before current interest period ends),

- you can add more interest periods.

- Open

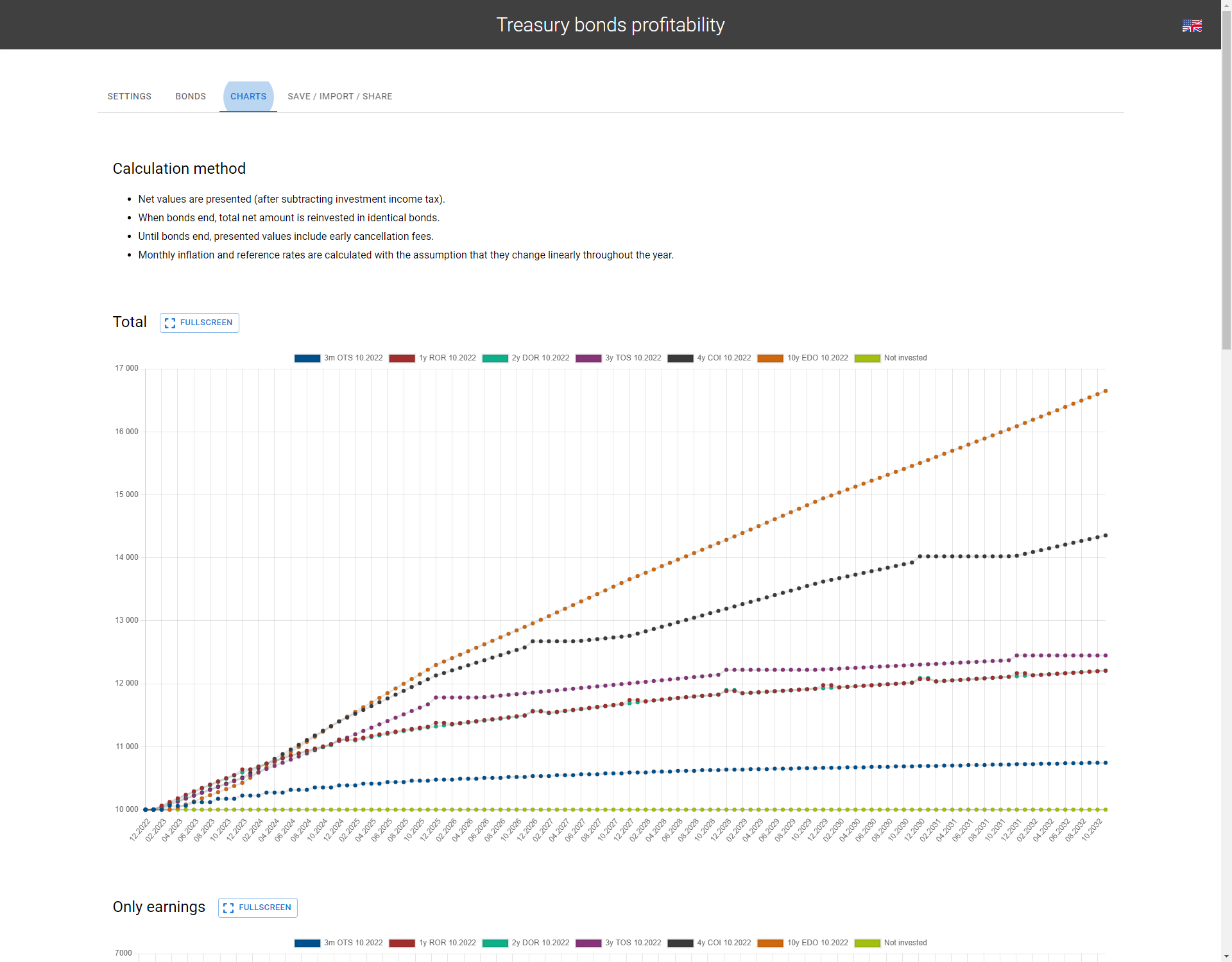

Chartstab to compare bonds. There are 4 charts available:- "Total": amountInvested + interest - cancellationPolicy(if applicable) - incomeTax,

- "Only earnings": does not include amountInvested,

- "Total, adjusted for inflation": same as "Total", but reduced by inflation; example: total=575, inflation=15%; adjustedTotal=575 / (1 + 0.15)=500,

- "Only earnings, adjusted for inflation": same as "Only earnings", but reduced by inflation.

- If you want to save, export/import or share your results, go to

Save / Import / Sharetab.